Crowdfunding:

As we all know, financial aid is required to grow a company. This can be a breeze for companies with larger capital. But how can Small-scale companies or startups afford such high funding /money/gains? Large companies can easily afford it with the help of investments because they hold goodwill and trust in the market which helps them to easily pull funds to invest, but for small-scale companies or startups, it can be an uphill battle. But there is also someone who can help them to tackle such problems holding a great valuable position in the financial world. The aid is known as Crowdfunding.

We might have a lot about this phase in our lives.

But do we know the actual meaning of Funding?

As we are well aware of the fact that nowadays Crowdfunding is leaping into the financial market. We might also have heard about it. Today it has become so famous, maybe you too would think that this is a new concept. But in reality, funding has been around for centuries and it is rising above something today with the help of some online platforms, so it will be very fruitful for you to know what crowdfunding is. But a lot of questions may cross our mind like :

- Are there any drawbacks along with its benefits?

- And are there different types of crowdfunding?

So let us discuss a few points to gather information about crowdfunding.

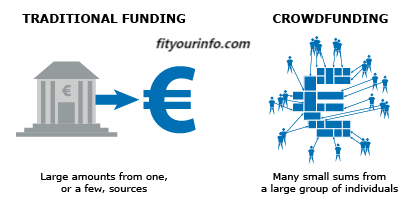

Crowdfunding is a way in which money is raised to finance projects and businesses. Traditional financing methods involve raising funds from a small group to run a project or business, where money can be raised from a large group of people through funding. To raise funds, social media platforms for crowdfunding websites have played a significant role. With the help of this companies can connect investors or entrepreneurs with a large group of investors.

The most special thing about this funding is that investors can contribute from very small amounts to very large amounts. Through this, money can be raised for different purposes like starting a business, developing a new product, helping a needy person or supporting a social cause.

Benefits of funding

Through this funding, startups and businesses not only get funds but also get benefits along with it. Like market validation because your business idea is presented to the public for fundraising. It seems to be easy to find out based on people’s interest in it What is the future of such an idea or what is the demand for the service of our product?

This also helps in building an audience or creating awareness for your project. Along with this, you also get feedback before launching the official image of your product or service. Which helps a lot in improving it.

A successful crowdfunding campaign can be an effective tool for publicity and marketing and makes it easier for industries to reach potential partners and other funding sources. The chances of future investment opportunities also increase and this fundraising is done using crowdfunding platforms that charge a fee for their services, which is often a percentage of the funds raised.

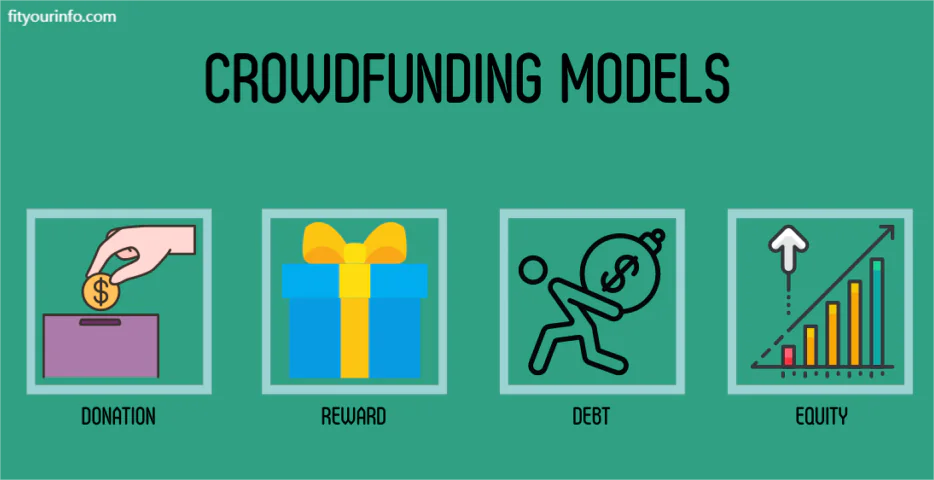

Types of Crowdfunding

- REWARD-BASED CROWDFUNDING

- Equity-Based Funding

- DEBT-BASED FUNDING

- DONATION-BASED FUNDING

Let us now discuss the types of crowdfunding.

REWARD-BASED CROWDFUNDING:

Startups often use this model to launch a new product or service that requires funding for its development. In this type of funding, investors are given a reward in exchange for providing funding. Which is often a product or service of the startup.

KICKSTARTER and IndieGoGo are famous reward-based crowdfunding platforms to use this type of crowdfunding. In this type of crowdfunding, one does not have to give any share in the ownership of the company. Only rewards have to be given hence this is a plus point of this type. This is also a very good way to know the interest of the market regarding your product or service. However, its negative point can be that if the startup is not successful in giving rewards. Its reputation may be damaged and supporters can even demand their funds back.

EQUITY-BASED FUNDING:

In this type of equity-based crowdfunding, the company gives shares of the company to its investors in exchange for investment. Startups with high growth potential use this model because a large amount of funds can be raised by giving shares of the company. SEEDINVEST and CIRCLE UP are equity-based funding platforms for using this type of funding. The plus point of this type is that investors prefer to pay a larger amount because they get equity. This helps in building a long-term relationship between the investors and the company.

The perk (negative point) of this crowdfunding is that offering equity in the company means giving a portion of your ownership to the investors, who somewhere have to share the control and decision-making of the company. The losses and regulations associated with this are quite complex and there is always pressure on the investor to give returns.

DEBT-BASED CROWDFUNDING:

This is also called PEER-TO-PEER LENDING or P2P LENDING. This is like a traditional loan, the only difference is that instead of taking a loan from a bank, the loan is taken from a crowd of investors. In this, the startups agree that they will return the loan within a specific period. LENDING CLUB and PROSPER are similar crowdfunding platforms.

The Perk (plus point)of this crowdfunding is that, unlike equity crowdfunding, there is no need to give equity in this and the responsibility of the investors is fulfilled by paying the loan. This type of loan is available quickly as compared to the traditional loan method. But its minus point is that one has to pay interest along with the loan.

DONATION-BASED FUNDING:

Donation-based crowdfunding This kind of crowdfunding model is used by such profit organisations which do charitable work for community benefits. In this the donors do not have any expectations of financial returns, rather they have faith in a welfare project that will help the society in some way and the donors will feel good by contributing to it. GOFUNDME is a donation-based crowdfunding platform. Its biggest plus point is that it is done for social causes and the benefit is that there is no payment or equity exchange involved in it. This also builds a community of supporters who are sensible for social causes. The downside ( negative point) of this crowdfunding type can be that sometimes its appeal may reach only a limited audience due to which it gets less success.

After learning about these most important four types of crowdfunding platforms we should also learn about some important points.

Some important points should always be kept in mind before using any type of crowdfunding.

- So first of all you should choose the type of crowdfunding according to the nature of your business or project. So that the chances of the business being successful are high. If you want to launch a new product or service then choose reward-based funding. If you want to raise a large amount by giving equity then equity-based funding is the best. If you have the confidence to repay the loan then Debt-based funding will be the right choice and if there is a strong social mission then donation-based crowdfunding will be a good choice for it.

- Apart from the nature of the business, it is also important to select the crowdfunding type as per the financial needs because, for large amounts, equity and debt-based funding options can prove to be appropriate. For small amounts, reward and donation-based crowdfunding is suitable.

- The importance of market validation is immense for business, therefore, if there is a need to test your product or service in the market then reward-based funding should be used so that both customer feedback and validation can be obtained.

- It is also important to make decisions while keeping the ownership of your business in mind because if you want to keep full ownership of your company with you then instead of equity-based crowdfunding, you can choose either reward-based funding or debt-based crowdfunding. It is also important to check the ability to fulfil promises. Reward-based funding should be chosen only if rewards can be produced and delivered on time. Similarly, debt-based funding should be applied only if the loan can be repaid on time.

If such a large number of equity holders can be easily managed, only then the equity-based crowdfunding option should be chosen.

Legal Requirements

- It is also very important to keep the legal requirements in mind. Therefore only funding whose legal requirements can be fulfilled can be used. The regulatory requirements are quite complex as compared to reward-based crowdfunding. It is very important to take action after keeping this in mind.

In this way, by considering all these major points. You can understand which crowdfunding type will be suitable for you so that you can be a success in it.